How to do financial forecasting properly

3-Way Forecasting: a smarter approach to business planning

Financial forecasting is an essential tool for businesses, enabling them to make informed decisions, manage budgets, and develop strategic plans.

In today’s dynamic business landscape, smart financial planning is essential. One powerful yet often under-utilised tool is “3-way forecasting”, which provides a holistic view of a business’s financial future.

3-way forecasting combines projections from the three traditional financial statements:

- Profit and Loss (P&L) – also known as the income statement, this forecasts revenues, costs, and profits over a period of time.

- Cash Flow – tracks the movement of money in and out of the business, showing how cash is generated and spent.

- Balance Sheet – projects the company’s financial position at a specific point in time, including assets, liabilities, and equity.

Why 3-Way Forecasting Matters

Actual accounting statements are prepared with the discipline imposed by the double entry debit and credit system which means that, for example, you can’t record a sale into the P&L account (a credit) without also recognising that there is also a debit side to the transaction being either an invoice issued to a debtor or a cash receipt.

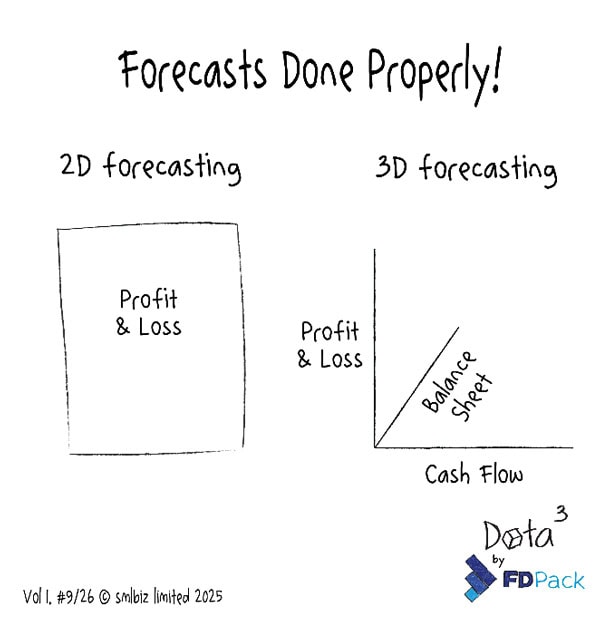

When it comes to forecasting anyone can create a profit & loss on a spreadsheet by simply listing revenue and expenses that will only tell part of the story.

This doesn’t show however the cash flow implications of the proposed P&L. For example, will the business have the finance it requires to deliver the predicted level of activity, and what does the balance sheet look like at the beginning and end of the period?

Historic and forecast financial statements built using different methods also create an inefficient and unnecessary barrier between the past and future – making comparisons and trend analysis cumbersome and sometimes impossible.

3-way forecasting can create P&L, Cash Flow and Balance Sheets using the same double entry discipline as the historicals, ensuring that the three statements are integrated and that the forecast produces a complete view of all the financial implications of the choices being made.

Actuals and forecasts should be held in a single database and in the same transactional format, making them easily interchangeable and allowing seamless travel along a timeline between the past and future.

By linking the P&L, cash flow and balance sheet statements it is possible to:

– Anticipate cash shortfalls even if profitability looks strong.

– Test scenarios such as price increases, delayed payments, or hiring plans.

– Align growth strategy with financial capacity.

– Build credibility with investors, lenders, and stakeholders who expect rigorous financial planning.

How to do financial forecasting properly

3-way forecasting isn’t just for large businesses, it’s also a critical tool for startups and small businesses too. By bringing clarity to the financial future, it helps to make smarter decisions, avoid surprises, and stay agile.

Whether you are seeking funding or simply planning for growth, 3-way forecasting offers the strategic insight every business needs to thrive.

FDPack have been pioneers in the field of 3-Way forecasting and have many years’ experience in how to build integrated forecasting models that can be trusted to provide a complete picture of where a business is heading.